If you’re a delivery or rideshare driver in the U.S., you know that every mile counts—not just for your earnings, but also for your taxes. The IRS recently announced that the 2025 standard mileage rate has increased to 70 cents per mile, up from 67 cents in 2024. This might seem like a small bump, but for drivers logging thousands of miles, it can add up to significant savings. In this guide, we’ll go over what this means and how you can claim your tax deduction.

What’s the 2025 Mileage Rate for Drivers?

Starting January 1, 2025, the IRS standard mileage rate for business use is 70 cents per mile. This applies to all delivery and rideshare drivers who use their vehicles for work. So if you drive for Uber, Lyft, DoorDash, or any other gig platform, this rate is your go-to for calculating mileage deductions.

Protect yourself from false accusations and disputes with a reliable dash cam: https://amzn.to/3J7rbZ3

Protect yourself from false accusations and disputes with a reliable dash cam: https://amzn.to/3J7rbZ3

How to Maximize Your Deduction

As a delivery or rideshare driver, your vehicle is your most important tool—as well as your biggest expense. Tracking your miles and using the standard mileage rate can significantly reduce your taxable income. Here’s how it works:

Track Every Mile

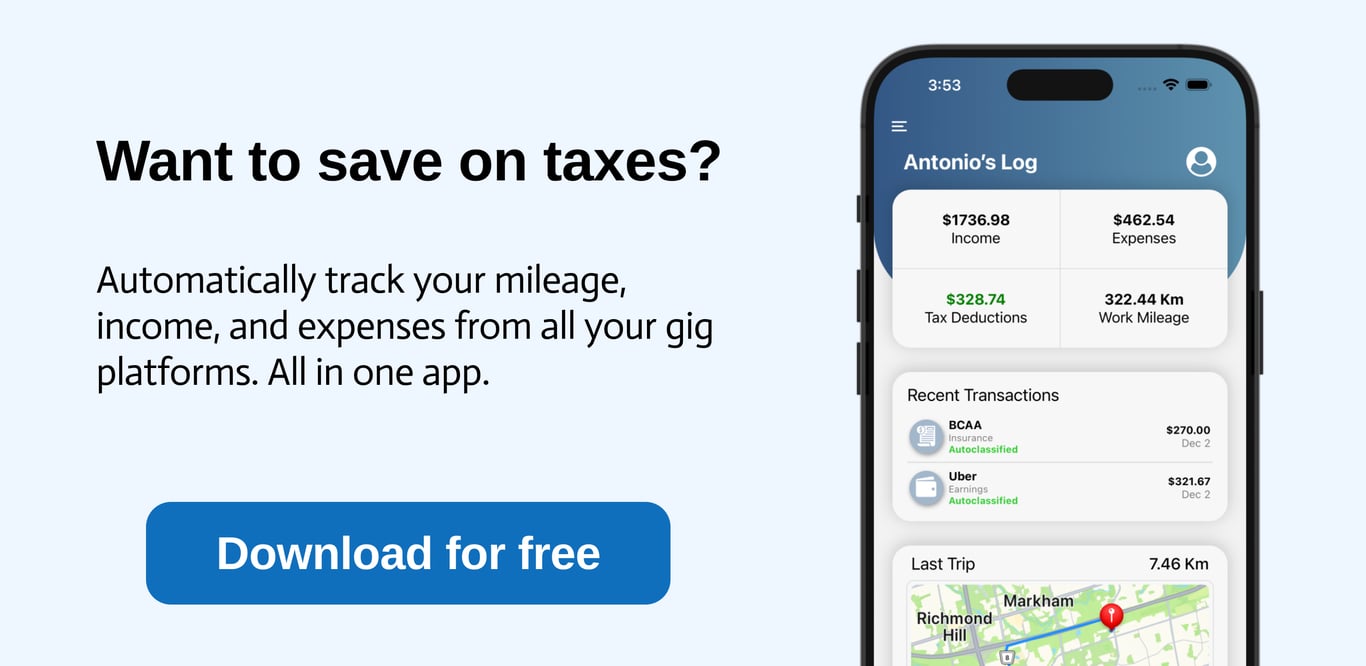

Keep a detailed mileage log showing how many miles you drove for work (more on this below). Apps like RideWiz help you do this automatically.

Calculate Your Deduction

Multiply your business miles by 70 cents. For example, if you drove 10,000 miles for work in 2025, your deduction would be $7,000.

Compare to Actual Expenses

If your actual expenses (gas, repairs, insurance, etc.) are higher than the standard mileage deduction, you can choose to deduct those instead. But for most drivers, the standard rate is simpler and more beneficial.

What’s Behind the Increase?

The 3-cent increase in the business mileage rate reflects rising costs of vehicle ownership and operation, including higher insurance premiums, repair costs, and depreciation. According to the IRS, the rate is based on an annual study of fixed and variable costs, with depreciation now accounting for 33 cents per mile (up from 30 cents in 2024).

For delivery and rideshare drivers, this means you’re getting a little extra help to offset the wear and tear on your vehicle.

Requirements for Tracking Your Mileage

Keep Detailed Records

The IRS requires proof of your mileage, so keep a log of your trips, including dates, destinations, miles driven, and purposes.

Know What Counts as Business Miles

Driving to pick up a passenger or deliver food? That’s a business mile. Driving to the grocery store after your shift? That’s personal.

What About Electric Vehicles (EVs)?

What About Electric Vehicles (EVs)?

If you’re driving an EV for deliveries or rideshare, you can still use the same standard mileage rate. This is great for EV owners as these vehicles often have lower operating costs (like no gas expenses), so using the flat rate can actually result in a higher profit after tax.

The Bottom Line

By tracking your drives and keeping detailed mileage logs, you can lower your taxable income and keep more of your hard-earned money.

So, start logging those miles today—your future self will thank you at tax time!