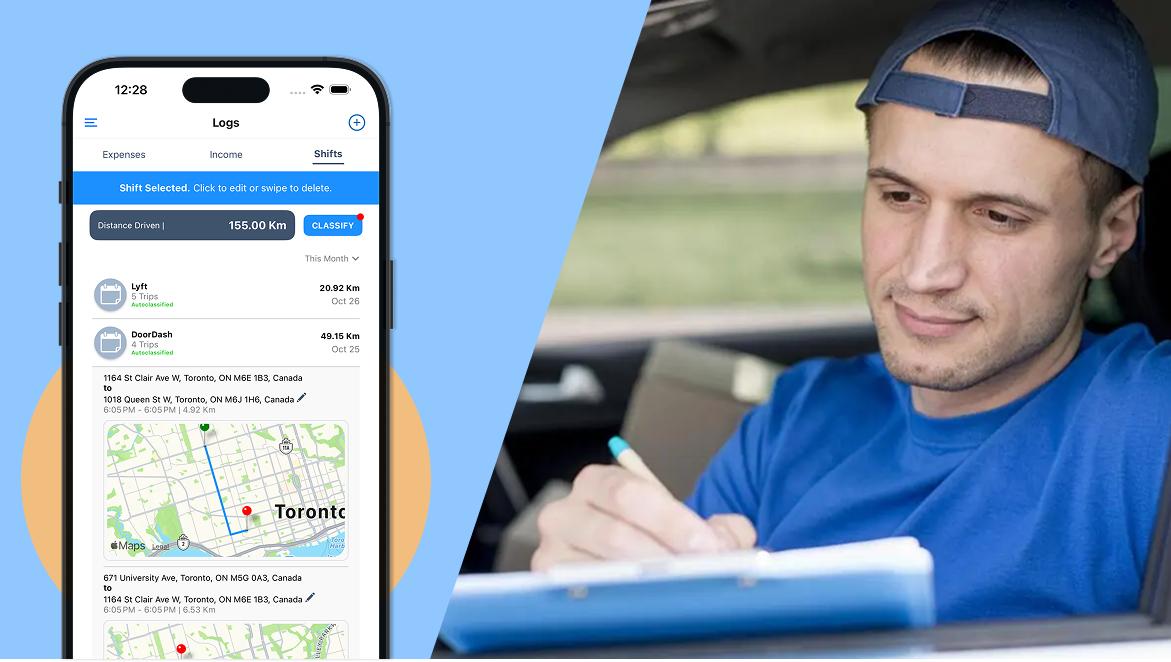

As a gig driver for platforms like Uber, HOVR, or DoorDash, making sure you’re tracking your mileage and expenses is key to maximizing your earnings and claiming your deductions. In both Canada and the U.S., drivers can deduct vehicle-related expenses by using either the standard mileage rate (U.S.) or the itemized method (Canada). How you track these deductions is up to you—some prefer manual record-keeping, while others rely on technology. In this guide, we’ll break down the pros and cons of each approach and highlight key insights drivers wish they’d known sooner.

Manual Tracking vs. Mileage Tracking Apps: Pros and Cons

Manual Tracking (Spreadsheets/Logbooks)

Pros:

Free

Suitable for occasional drivers

No reliance on technology

Cons:

Time-consuming

Prone to error (e.g., non-compliant format, incorrect odometer readings)

Can be lost or damaged

Difficult to share with an accountant

Mileage Tracking Apps

Pros:

Mileage is tracked automatically

Safe choice as your records are audit proof

Tax reports can be generated in seconds instead of hours

Records are easily shared with an accountant or tax filing platform

Cons:

Subscription cost (it is tax-deductible)

May affect battery life

One thing driver's wish they knew sooner: Many discover that what seems like "free" manual record-keeping ends up costing them hours of compiling their records and professional accounting fees come April. Meanwhile, those who used an app to track everything can simply download their report and take advantage of free filing—usually completing their taxes in just 30 minutes. Make sure to consider not just the time and money you’re spending today, but also how you’ll prepare your taxes when it’s time to file.

Protect yourself from false accusations and disputes with a reliable dash cam: https://amzn.to/3J7rbZ3

Protect yourself from false accusations and disputes with a reliable dash cam: https://amzn.to/3J7rbZ3

Who Benefits Most from Apps Like RideWiz?

Frequent Drivers (2+ Shifts/Week): The more you drive, the more you stand to save by tracking all of your deductions automatically. And since RideWiz is tax-deductible, you can write off the full cost when you file.

Drivers Who Value Convenience: Apps let you turn what used to be a daily chore into something that happens effortlessly in the background while you earn.

Canadian Gig Workers: The CRA requires detailed expense tracking, adding complexity. RideWiz simplifies this for you by organizing expenses and generating your T2125 report, in addition to tracking your mileage.

Multi-Platform Drivers: Managing mileage and income from multiple gig apps in one place saves time and eliminates the hassle of piecing together records.

The Role of Expense Tracking: Canada vs. U.S.

Canada: The CRA mandates detailed expense records (gas, maintenance, insurance). So, in addition to keeping track of mileage you are required to track expenses as well for the deduction calculation (see this guide if you’d like to learn how it works)

U.S.: Drivers can choose between the standard mileage rate or actual expenses. Apps let you track both, so you can pick the larger deduction at tax time.

What should I do with my records after I file?

Regardless of how you track your mileage/expenses, make sure to keep your records for at least 3 years (for U.S. drivers) and 6 years for Canadian drivers after filing! This is how far back the IRS and CRA can ask to see your records, so you want to make sure you keep them safe. RideWiz stores your records for you in the cloud for up to 6 years to make sure you always have access to them if you need them.